low cost prices cars laws

Most of these policies will certainly additionally cover the individual usage of your automobiles, as well as those dangerous void times when you are on the clock yet still not covered. If you are a rideshare driver, rideshare insurance policy is for you. No matter whether you deal with a full-time or part-time basis, you might be subject to major liability needs to something fail on the task.

Costs for rideshare insurance coverage can differ significantly from service provider to company as well as will certainly rely on a series of individual factors like credit rating, driving background, as well as location too. Maintaining that in mind, a rideshare insurance coverage might cost as low as $10 a month to upwards of dual the expense of a typical personal automobile insurance policy (car insurance).

"I can't get over just how simple the procedure of browsing for even more cost effective insurance policy was with Jerry! I have a clean driving document and could not understand why my insurance coverage prices kept going up.

credit credit cheapest car cheap

credit credit cheapest car cheap

Neither the rideshare firm insurance coverage neither your basic plan will totally cover you throughout the duration where you get on the work but haven't yet accepted a flight or shipment demand. Also if you are included in a crash in among the durations that is totally covered by the conventional Uber or Lyft company insurance plan and also you require to file an insurance claim, you will likely be liable for paying a $2500 insurance deductible. cheapest auto insurance.

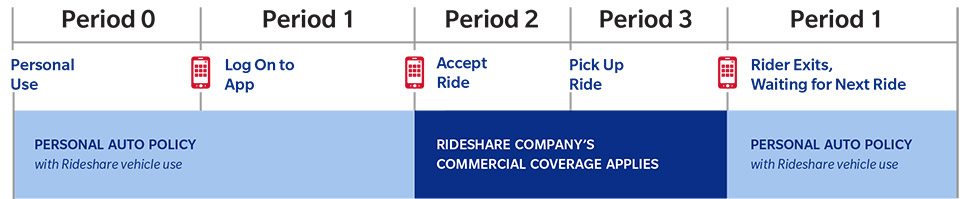

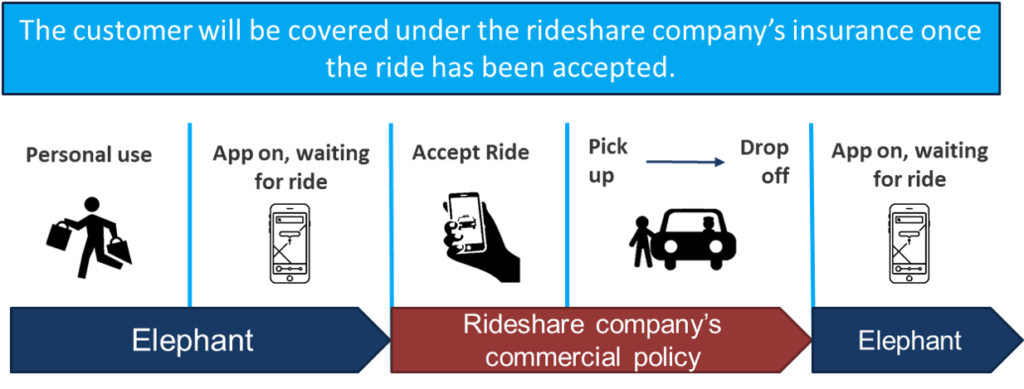

Uber and Lyft insurance coverage by duration In the case of Uber or Lyft, the firm insurance coverage policy either kicks in or doesn't begin according to a designated period of the flight that you remain in the procedure of completing. The system works as adheres to: This period covers any time when the rideshare application is not turned on. credit score.

If I Drive For Uber Or Lyft, Does My Insurance Go Up? - West ... - Questions

This duration describes the details amount of time where your application is activated however you are still awaiting or have not yet approved a client demand - affordable. This is the void period where you are not covered by your common personal insurance coverage or Browse this site the rideshare application policy. If your business insurance plan offers insurance coverage now, it will certainly be extremely restricted.

When you accept a flight request as well as go out towards your set destination, your rideshare firm insurance coverage will fully enter into result. dui. When you select up a passenger and also have them in your cars and truck, you are still completely covered by your rideshare company's insurance coverage plan up until the trip is marked full.

affordable car insurance risks cheap auto insurance cheap auto insurance

affordable car insurance risks cheap auto insurance cheap auto insurance

This is where rideshare insurance covers the spaces. vans. You will be covered by the very same continually strong policy no matter whether you are on or off the work at any particular time. Shipment service insurance policy by period If you are driving for a shipment application solution, it is essential that you spend some time to have a look at your business car insurance plan to learn exactly what you are covered for and also what isn't covered.

During this duration, you will be covered by your personal insurance coverage. This period refers to the certain amount of time where your app is turned on but you are still awaiting or haven't yet accepted a shipment request. affordable car insurance. During this space period, you may not be covered by either your basic personal insurance coverage or the shipment app's policy.

cheaper car insurance accident perks cars

cheaper car insurance accident perks cars

Several motorists will call for an extra rideshare insurance coverage to make certain they are covered throughout this in-between period. Unlike Uber or Lyft, not all shipment application firms will give you with company insurance coverage when you are driving to grab a distribution yet have not gotten the product yet. In many cases, as soon as you accept a demand as well as head out toward your collection location, your distribution app business insurance policy will totally or partially come into effect. auto.

Little Known Facts About Rideshare Insurance: How To Ride The Wave - Agency Height.

However, if your company doesn't supply insurance, you will certainly be left at risk need to you be associated with a mishap while supplying an item. As you can see from above, many shipment application vehicle drivers might possibly be left uninsured at any type of duration of the process. At various other times, you could only obtain minimal protection by your business insurance plan if in any way.

prices vehicle laws affordable car insurance

prices vehicle laws affordable car insurance

State Ranch rideshare insurance coverage is available in practically every state (with a couple of exceptions) and does not included any pesky strings like mileage constraints affixed - money. If you help both a rideshare service and also shipment app solution like Uber, Consumes, you can expand your protection without having to bother with paying a higher costs.

The Allstate rideshare insurance policy works as an add-on to an existing private vehicle insurance coverage plan. cheaper auto insurance. Essentially, must you be associated with a crash while in any one of the periods covered by your rideshare business policy, the personal rideshare add-on will certainly help you cover the distinction in between the company deductible and also Allstate's much reduced ordinary insurance deductible of about $500.

On the downside, you have to have an existing Allstate cars and truck insurance plan in position in order to subscribe as well as Allstate doesn't ensure that you will certainly be covered when you are on the work, so you still might be left at risk throughout the space periods while working (automobile). Progressive's rideshare insurance protection, The stand-out feature of Progressive's rideshare insurance package is that it is just one of one of the most customizable rideshare insurance policy prepares available.

For example, they represent "on" and "off" periods of the year while appreciating the comfort of understanding that you will certainly be covered year round without overpaying for your insurance coverage. The disadvantage to the Modern rideshare strategy is that the prices system is not really transparent and it is highly personalized, making it challenging to accurately evaluate choices when you contrast cheap cars and truck insurance policy prices quote.

The Ultimate Guide To Rideshare Insurance For Lyft And Uber: What Are The Options?

It is an excellent concept to have the adhering to documents available need to they be called for: Any kind of pertinent Rideshare business certificate, A copy of the Rideshare firm regulations, Evidence of your individual insurance coverage, While awaiting the police to show up, preferably, exchange any kind of appropriate details with the other chauffeur. This ought to consist of the following: Legal name, Contact details, Insurance information, Call your individual insurance service provider as soon as possible (insurance companies).

Rideshare insurance coverage has actually come to be progressively popular recently with the development of business like Uber as well as Lyft. If you're helping a rideshare firm, you'll require special security that isn't covered under your basic personal auto plan. Discover how rideshare functions and also what you can do to make sure you have the appropriate defense for your car.

Fortunately is that you wouldn't require a separate personal car plan because a for-hire livery policy can cover you for both business and also personal use. affordable. We use for-hire livery insurance coverage in 38 states. A lot more Info.

Your personal insurance provider can deny your insurance claim or drop you as a customer if you exist regarding using your vehicle to make deliveries. You might even be charged with insurance scams. Furthermore, distribution business treat vehicle drivers as independent contractors, so they do not have to give substantial insurance protection, either.

If you depend on a shipment business's insurance policy, you will not have insurance coverage on your own or your auto while you are waiting on an order request. As well as for business like Instacart as well as Grubhub, the business does not give insurance policy coverage for any type of factor in the process. It is additionally crucial to note your personal cars and truck insurance policy will not provide coverage while your distribution application is on, whether you are waiting for a request or proactively selecting up or delivering.

The Main Principles Of Rideshare Insurance In Chicago

That indicates State Ranch customers that drive for distribution solutions can avoid the added cost of an organization policy or rideshare add-on. If you don't have a policy with State Farm and don't desire to switch, the following ideal way to obtain delivery insurance policy coverage is by purchasing a rideshare Add-on that covers shipment driving (cheaper auto insurance).

As an example, if you drive for Instacart or Grubhub, be sure to buy a plan that will cover you no matter whether you have food in the automobile. Business policies are typically much more expensive, however it's much better to pay added for the appropriate protection than to deal with the monetary consequences of an accident that is not covered by your insurance coverage.

This is thought about the "void" in insurance coverage given that you practically don't have any throughout this time. Take into consideration these phases: You're covered by your individual car insurance plan - cars. You're not covered by your individual automobile plan, and also you have actually restricted insurance coverage under your rideshare firm's insurance. * You're covered by your rideshare business's insurance coverage.