What does obligation insurance coverage not cover for a vehicle mishap? Obligation insurance coverage aids cover problems you are in charge of to one more party since of a crash. That means it does not cover damages to your home or your injuries (cars). Your damages as well as injuries are shielded under various other protections such as: Just how much does liability coverage expense? The cost of obligation insurance policy coverage as component of your auto insurance policy depends on numerous aspects.

Higher protection restrictions might cost more. Do I require responsibility insurance policy? Yes. Most states (not all) require liability insurance policy to lawfully drive your car. The required limits differ by state. You will have a look at your state on the state information pages. Responsibility insurance coverage also helps shield you, up to your restrictions, by spending for covered damages as well as injuries in at-fault crashes (cheaper cars).

Just how much liability protection do I need? Obligation coverage ought to be customized to fit your requirements. It's not one-size-fits-all. vehicle insurance.

cheaper auto insurance cheap insurance low-cost auto insurance vehicle insurance

cheaper auto insurance cheap insurance low-cost auto insurance vehicle insurance

Home Damage Obligation protection is one component, along with Physical Injury Obligation insurance coverage, that comprises Responsibility insurance coverage. If you ever before trigger an accident, your Building Damage Obligation coverage will certainly spend for the damages done to any person else's building, whether it's an additional automobile, a lamppost, and even a house, as much as the picked quantity.

The Definitive Guide for Auto Insurance Shopping Guide - Illinois.gov

car insurance cars liability laws

car insurance cars liability laws

That requires building damage responsibility coverage? Every person needs Building Damages Responsibility coverage. Residential property Damages Liability insurance coverage safeguards you in situation you trigger a mishap that leads to damages to the property of others - auto insurance. In the majority of circumstances, this insurance is required by regulation. If you have a filing on Go to the website your business vehicle insurance coverage, you are called for to have Home Damage Liability insurance coverage.

When you choose a split limitation, the Building Damage limit is the third number. This number might likewise be revealed separately as a single number. As an example, if you selected a restriction of $10,000, your Residential or commercial property Damage insurance coverage would certainly compensate to $10,000 for all of the building harmed in a mishap triggered by you - vehicle.

In this situation, one number is used to define the limits for both your Physical Injury Responsibility insurance and your Home Damages Responsibility insurance coverage - insurance affordable. If you chose a consolidated solitary restriction (CSL) of $1 million, your insurance company would pay up to $1 million for all medical and also injury-related costs as well as all residential or commercial property damages costs that you created in an accident.

vehicle insurance credit score insurers cheaper cars

vehicle insurance credit score insurers cheaper cars

If you chose a combined single restriction for your Responsibility insurance policy, every one of the damages would certainly be hidden to the single limitation picked (cheaper car insurance). Residential property damage responsibility coverage constraints Your Residential or commercial property Damage Responsibility insurance coverage limitations can not surpass your Bodily Injury Liability insurance coverage per-person limits if you select a split limit for Responsibility.

Ohio's Minimum Coverage Requirements For Auto Insurance Fundamentals Explained

State minimums Each state sets laws pertaining to how much Residential or commercial property Damages Liability insurance coverage its homeowners are required to have (suvs). Progressive understands the demands for each state as well as will make sure you have at least the minimum amount of Home Damages Responsibility protection called for to fulfill your state's regulations.

insurers cars insurance vehicle

insurers cars insurance vehicle

Trailers Bonus trailers are billed a flat fee for Home Damages Responsibility coverage. Residential or commercial property damage obligation exemptions Just like all insurance coverage, there are exemptions to what is covered by Building Damages Obligation protection, as well as these are fairly conventional throughout the market. No liability plan will protect you against intentional acts (cheap insurance).

When requesting cost quotations, it is essential that you offer the same info per agent or company. The representative will usually request the adhering to info: summary of your car, its use, your vehicle driver's permit number, the number of chauffeurs in your family, as well as the protections as well as limitations you desire. cheaper cars.

You will certainly be asked to address a number of concerns concerning yourself, where you live, your wanted level of coverage, and also your car or house (auto). Responding to these questions to the most effective of your capability ought to lead to a much better rate estimate. Where to Shop, Examine online, the paper and yellow web pages of the phone book for firms as well as representatives in your area (insured car).

Top Guidelines Of Car Insurance – Liability Coverage

liability cheap car cheap low cost auto

liability cheap car cheap low cost auto

Specifically, ask them what sort of insurance claim solution they have actually received from the companies they recommend. Remember to shop around to obtain the best cost and also service. You can locate a list of insurance provider and their market share in South Carolina on our Market Assistance page. For Your Protection, Once you have actually picked the insurance protections you need and also an insurance policy representative or business, there are actions you can require to make sure you obtain your cash's well worth - insured car.

It is prohibited for unlicensed insurers to offer insurance coverage and also, if you buy from an unlicensed insurance firm, you have no assurance that the coverage you spend for will certainly ever before be honored (vehicle insurance). Read Your Plan Very Carefully, You need to be conscious that a vehicle insurance plan is a legal contract. It is written so your legal rights and also duties, in addition to those of the insurance provider, are clearly specified.

You need to check out that plan as well as make specific you comprehend its contents. If you have inquiries about your insurance coverage, call your insurance coverage agent for clarification.

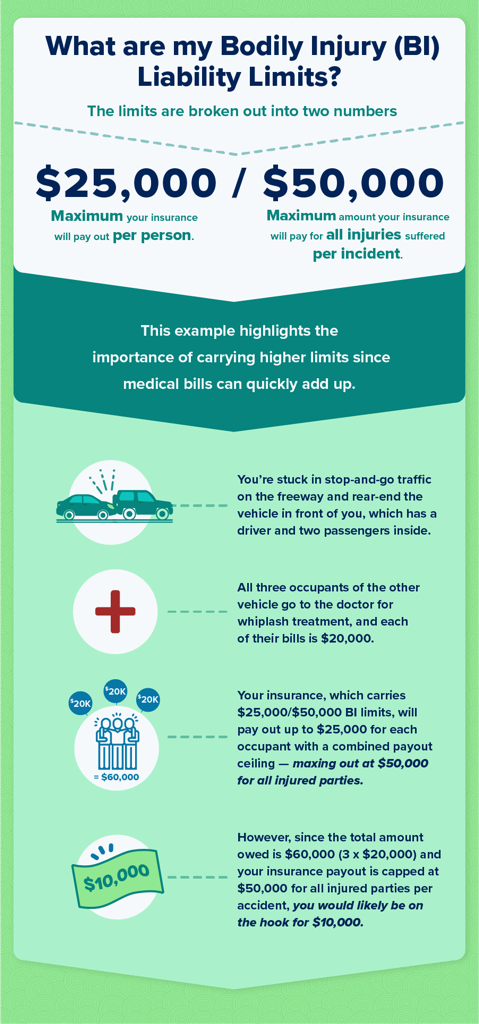

Just how much cars and truck insurance coverage do you require? The answer depends on a number of variables, consisting of where you live, just how much your cars and truck is worth, and also what other possessions you require to shield. vehicle insurance. Here's what you need to recognize. Secret Takeaways Most states need you to contend least a minimal quantity of insurance coverage for any type of injuries or home damage you cause in a mishap.